The Yield Curve Inversion: Harbinger of Doom, Early Warning Sign, or a Bunch of Hype?

Submitted by JMB Financial Managers on August 27th, 2019

It seems like the daily news is full of impending recession warnings from a media desperate to see the current president lose his bid for re-election. (When you look back at history, the start of a recession during an election year has not bode well for an incumbent. Reference George Bush in 1988 as the most recent example.) But is the current yield curve inversion really a sign that a recession will begin any day now as the media would have you believe? Is it even something you should be concerned about? Let’s take a look at what history and market experts are telling us.

What is History Telling Us?

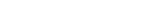

An inverted yield curve has preceded 8 of the past 9 recessions, so it is likely in your best interest to pay attention here. The inversion itself is not consistent in its ability to tell you when a recession will begin, however. The average length of time between an inversion and the start of a recession has been eighteen months, with the bulk of occurrences falling between 12 and 24 months. (source: Barrons)

Thus an inverted yield curve has been more of an early warning sign than a harbinger of doom. Thus, you shouldn’t expect a recession to begin anytime soon, but know the next recession could be as little as a year away -- based upon past performance of the inverted yield curve.

Past performance does not guarantee future results, however, so it is possible that this just media hype.

For one thing, there is no cause-and-effect relationship here, meaning the yield curve inversion doesn’t cause a recession, it is merely a condition that becomes present before recessions begin. (Another way to say this is that you only know it predicted the recession when you look back in time during a recession.)

What About Interest Rates?

Another fact to consider is that most every prior yield curve inversion has been caused by the Federal Reserve Bank raising interest rates to the point where short-term interest rates are higher than long-term interest rates. When this happens, the inverted yield curve becomes a self-fulfilling prophecy by causing a reduction in lending by financial institutions, which causes both business and consumer spending activity to decline. When you look at the current inversion, it has not been caused by the Federal Reserve; rather it has been caused by a massive rally in the bond market, which could make this inversion different.

Often overlooked in the current yield curve inversion discussion is the effect of Quantitative Easing (“QE”) conducted by the Federal Reserve Bank in the years after the last recession. According to a study published by the Federal Reserve Bank itself, the bank’s purchase of 10-year treasury bonds under the QE program has pushed the interest rate on the 10-year treasury bond a full 1.0% lower than it would be had QE not taken place, and this would gradually be eliminated by 2025 if the unwinding of the bank’s balance sheet is completed by then. Thus, if you had 1.0% to the current 1.5% yield on the 10-year treasury, you come up with 2.5% -- and a yield curve that is NOT inverted at this point in time. Again, it is possible the current inversion is different.

Leading Economic Indicators

Shifting our attention away from the yield curve for a moment, let’s take a peek at the Leading Economic Indicators (“LEI”) and the Coincident Economic Indicators (“CEI”) which are published by the Conference Board, which also provide a very effective recession warning sign. When the reading for the LEI has fallen below the reading for the CEI a recession has followed in each of the occurrences since 1959. (source: Bespoke Invest) What is this reliable indicator telling us? It is telling us a recession is nowhere in sight, as the LEI remains above the CEI as of last month’s data.

We all know that the business cycle is not going away, because human nature never changes. Innately, human behavior is not all that different today than it was 1,000 years ago as behavioral scientists like to remind us. So when it comes to recessions, the question is when, not if. The weight of evidence (not all of which was addressed in this article) is that there is low probability of a recession starting in the next 18 to 26 months.

How Do These Changes Impact You?

If you would like to discuss how your investments or retirement planning could be impacted by a recession and steps you can take to be prepared, call or email us and we’ll be happy to provide our insights.

--

About the Author

Jack Brkich III, is the president and founder of JMB Financial Managers. A Certified Financial Planner, Jack is a trusted advisor and resource for business owners, individuals, and families. His advice about wealth creation and preservation techniques have appeared in publications including The Los Angeles Times, NASDAQ, Investopedia, and The Wall Street Journal. To learn more visit https://www.jmbfinmgrs.com/.

Jack Brkich III, is the president and founder of JMB Financial Managers. A Certified Financial Planner, Jack is a trusted advisor and resource for business owners, individuals, and families. His advice about wealth creation and preservation techniques have appeared in publications including The Los Angeles Times, NASDAQ, Investopedia, and The Wall Street Journal. To learn more visit https://www.jmbfinmgrs.com/.

Connect with Jack on LinkedIn or follow him on Twitter.

JMB Financial Managers Mid-Year Review for 2025

Click the button below to download a pdf of insights and predictions for the rest of the year.