The True Costs of Caring for Aging Parents

Submitted by JMB Financial Managers on November 10th, 2025.jpg)

Key Takeaways

- Caring for aging parents is a growing reality for many Americans.

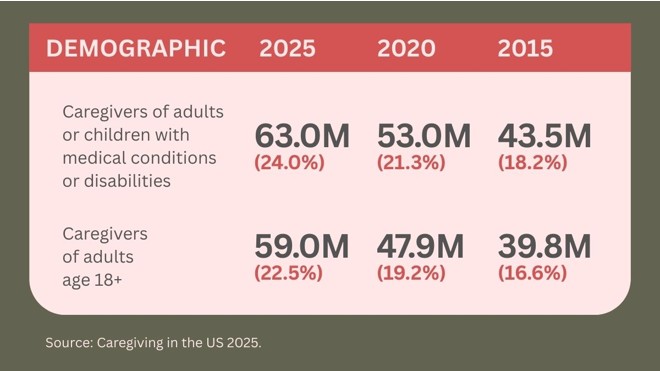

- The number of family caregivers in the U.S. has jumped to 63 million, a 45% increase over the past decade, making 1 in every 4 Americans a caregiver.

- The average caregiver is 51 years old, with women accounting for 61% of the total.

- Most caregivers either live with their care recipient or within 20 minutes.

- As of 2025, nearly 30% of caregivers provided care for five or more years and spent an average of 27 hours per week providing care.

- Two-thirds of caregivers help with at least one activity of daily living, with 55% also performing medical or nursing functions. In addition, many caregivers find themselves in a coordination role with healthcare providers.

- There are emotional, physical, and financial costs involved in being a caregiver.

- 88% of family caregivers said they aren’t currently getting enough support.

- To do the best for their elderly parents, caregivers often need to navigate family dynamics and decision-making.

As you gather with family for the upcoming holidays, a growing number of Americans may discuss caring for aging parents around the dinner table. As financial professionals, we have many clients who have gone through this or are currently managing it today. We don't have all the answers to this extremely personal issue, but we thought it might be useful at this time of year to provide some information that may be helpful.

Scope and Scale of the Caregiving Challenge

If you are grappling with the issue of caring for aging parents, know that you are not alone. The number of family caregivers in the U.S. has jumped to 63 million. That’s a 45% increase just over the past decade, according to a joint 2025 report by AARP and the National Alliance for Caregiving (NAC). This means that almost 1 in every 4 Americans is a caregiver. Of the 63 million, 59 million people are caring for adults, with 4 million caring for children with an illness or disability.1

Who Are the Caregivers

The average caregiver is 51 years old, with women accounting for 61% of the total. Most are caring for relatives, usually parents or spouses, but 11% care for friends or neighbors. As you can imagine, the recipients of this care are primarily older adults, with nearly half being 75 or older. What makes this more challenging is that most of these older adults have multiple chronic health conditions, including age-related decline, Alzheimer’s or other dementias, mobility limitations, cancer, and postsurgical recovery.2

Proximity Equals More Responsibility

Most caregivers either live with their care recipient (40%) or within 20 minutes (35%).2 As you would expect, the closer you live to the recipient, the more care you provide and the less outside help you use.

Of those living with the care recipients, 35% provide more than 21 hours of care weekly. They are also less likely to use paid help (22%) or unpaid help (36%) than those who live apart from their care recipient. Among all caregivers, 32% use paid help, and 53% have unpaid assistance.2

What Type of Elder Care Is Given

If you are expecting to be a primary caregiver for your aging parents, expect it to be longer-term and more intensive than in the past. As of 2025, nearly 30% of caregivers provided care for five or more years. This is an increase from 24% in 2015.2

Today’s caregivers spend an average of 27 hours per week providing care, with nearly a quarter providing 40 or more hours per week. For this group, it’s equivalent to a full-time job.2

The study shows that two-thirds of caregivers help with at least one activity of daily living. This includes bathing, dressing, toileting, feeding, and mobility. Since 2020, an increasing number of caregivers have been providing help with multiple tasks.2

Many caregivers are called upon to perform other services, such as shopping, managing finances, preparing meals, and handling transportation.

55% of caregivers also perform medical or nursing functions, such as managing catheters, administering injections, and monitoring vital signs. Of those providing these services, only 22% received any training.2

In addition to performing physical wellness activities, many caregivers find themselves in a coordination role with healthcare providers. According to the AARP report, 70% of caregivers monitor their recipients’ health, 64% communicate with medical providers, and 58% become advocates on behalf of those they are caring for.2 This is a critical but often time-consuming and complex role.

Sandwich Generation: Multiple Pressures

The term “Sandwich Generation” refers to middle-aged adults who care for elderly parents and raise children simultaneously. This group, facing multiple responsibilities, has been growing because of demographic shifts in the country, where more adults are becoming parents later in life and more older adults are living longer.

Nearly one-third of all caregivers are looking after both an older adult with complex medical needs and a child under 18. Being part of the sandwich generation is even more common for younger caregivers under 50, where 47% have taken on this dual role.2

The Emotional, Physical, and Financial Costs of Caregiving

If you are caring for your aging parents or find yourself as part of the sandwich generation, you know it can take a toll on your emotional, physical, and financial health.

Emotional and Physical Health Impacts

Being a caregiver can be overwhelming. Multiple demands can cause emotional, physical, and psychological strain, resulting in anxiety, depression, irritability, insomnia, fatigue, and even physical ailments.

Feelings of guilt, grief, and the loss of independence can compound the physical strain of caregiving. Financial stress, lack of support, and the intimidation of navigating the healthcare system can add even more layers of complexity.

Chronic stress can weaken the immune system, increase the risk of heart disease, and exacerbate existing health conditions among caregivers. The long-term pressure and emotional impact of caring for aging parents can lead to burnout, a state of physical, emotional, and mental exhaustion.

Nearly two-thirds of caregivers experience moderate or high emotional stress, with 45 percent of caregivers reporting moderate or high physical strain.2

If you are in this situation, consider setting boundaries, managing expectations, and seeking assistance to help you navigate this tough period. Trying to do everything yourself is rarely the best approach. Here are some ideas we gathered from professionals in this area:3

- Seek Support: You may want to build a support network of friends, family, support groups, or professional counselors. By joining a support group, you can share experiences and seek insights.

- Self-Care: To do the best job for your parents, you should prioritize self-care. This includes eating right, exercising, getting enough sleep, and taking regular breaks. Make time to engage in activities you enjoy, providing a much-needed respite.

- Set Boundaries: Establishing boundaries and learning to say no when necessary may help you better cope with stress. Sharing the burden by accepting assistance and delegating tasks can help prevent burnout and help you pursue a healthier balance in your life.

- Educate Yourself: Learning as much as you can about your parents’ condition may better position you to find available resources and effective caregiving techniques.

- Respite Care: Taking regular breaks from your caregiving duties can be crucial. Whether through respite care services, hiring a temporary caregiver, or arranging for family members to step in, you need and deserve time to recharge.

- Professional Help: If stress becomes overwhelming, you should not hesitate to seek professional guidance. Trained therapists can provide coping strategies, stress management techniques, and a safe space to express your emotions.

Financial Impact of Caregiving

Financial strain is also common among caregivers. To cover expenses, one-third report that they have stopped adding to their savings, 24% say they have exhausted their short-term savings, and 13% have tapped into long-term savings, like retirement or education accounts. 23% report going into debt due to their caregiving responsibilities.1

There are 23 million people in the U.S. caring for an older adult—that’s more than the 21 million providing care to a preschool child.4 Many caregivers may wind up paying some or all of the cost of their parents’ care. The growing ranks of older baby boomers are creating new financial pressures on their children, who are using savings to hire help, pay for medical care, and modify homes to accommodate parents who need to move in.

About one-fourth of those 65 and older will eventually require significant support and services for more than three years.5

The cost of paid in-home care continues to rise. In 2023, the median price of a home health aide, hired through an agency, was $33 an hour nationwide, up from $20 in 2015. For those needing round-the-clock in-home care, that translates to a yearly median cost of nearly $290,000. That’s more than double the annual median price of a private room in a nursing home and four times the annual median cost of a private room in an assisted living facility.5

Extended care, provided either at home or in a facility, is costly and, unfortunately, is not covered by most traditional private health insurance. Your parents’ Medicare will only pay for extended care if they require skilled services or rehabilitative care for a limited time. For example, Medicare only pays for such services in a nursing home for a maximum of 100 days.6 Learn more about Medicare here.

Many older adults struggle with the costs associated with aging. About one-third of retirees don’t have the resources to afford even a year of minimal care, and only about 10% of adults 65 and older have insurance intended to cover extended-care expenses.5

That’s when family often has to step in and make up the difference. Families often provide in-home care themselves because they can’t afford to pay others, can’t find outside caregivers they trust, or need to supplement the paid care their parents can afford.

The Wall Street Journal in 2024 quoted a representative from an online community of caregivers who said, “The new inheritance is not having enough money to give to kids but to have enough money to cover long-term care costs.”5

The Need for Support

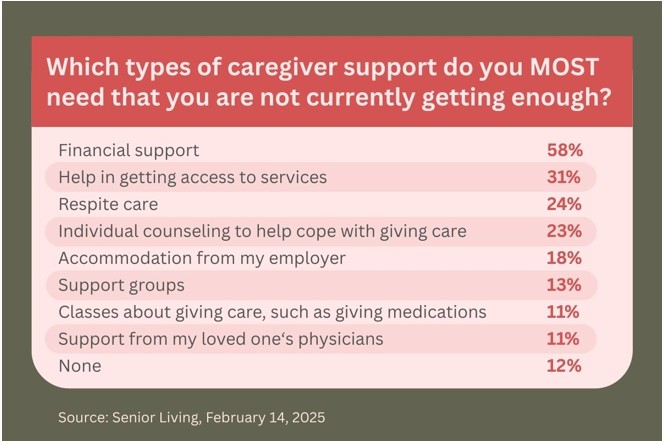

88% of family caregivers said they aren’t currently getting enough support. Unpaid family caregivers face tough challenges, leaving many in a vulnerable position. Nearly half of caregivers receive no formal support, such as financial aid, counseling, or respite care.7

Navigating Family Dynamics and Decision-Making

Caring for elderly parents shouldn’t be a solo responsibility. If you have siblings, the entire burden should not default to whoever lives closest, although that is often exactly what happens.

It’s an emotional time for family members, often involving disagreements and conflicts when there are different opinions on the best course of care. This can cause tension, frustration, and emotional strain for everyone involved.

Navigating conflict can be especially challenging for those who are responsible for the day-to-day care of the parent. Disagreements about medical treatment, living arrangements, and extended care needs can create discord in the family, ultimately hindering the quality of care provided.

Managing family conflict requires patience, understanding, and clear communication. Here are some strategies you may want to try to help navigate and resolve family conflicts over care decisions:8

- Create an open and honest dialogue. Help create an environment where every family member has a chance to express their feelings, concerns, and opinions about the care decisions. Clear and honest communication can help manage misunderstandings and find common ground.

- Set ground rules for family discussions. Clear boundaries and guidelines can help keep the conversation respectful, productive, and focused on resolution.

- Divide responsibilities clearly. It’s important to establish clear roles and responsibilities from the outset. Don’t end the conversation without knowing who will take on specific caregiving tasks (e.g., managing medications, helping with mobility, meal preparation). If possible, consider having everyone contribute, whether through direct assistance or by helping with other tasks (e.g., financial support or coordinating appointments).

- Seek mediation or professional help. If things get too tough, it may be best to seek professional mediation. A neutral third party, like a family therapist, mediator, or counselor, can facilitate difficult conversations and help steer the family toward resolution.

- Focus on the best interests of your parents. At times of conflict, it’s important to keep the focus on the well-being of the person who receives care. By shifting the conversation back to the needs of the person receiving care, it becomes easier to find common ground and make decisions in their best interest.

You Have Our Support

As financial professionals, we are not eldercare specialists, but we can help you develop a financial strategy that takes the cost of caring for aging parents into consideration.

Looking ahead is critical. Having discussions with your parents and other family members can help clarify wishes and avoid conflict and added stress later on.

There are also online tools that can help you calculate the cost of care.

As your parents age, consider taking a look at all of their legal and financial documents to see if they are in order. This includes their will, power of attorney, health care proxy, and advance directive. We can help you coordinate these important documents with their other professionals. Learn more about long term care insurance by reading our article here.

If you are currently caring for your parents, remember to leverage local agencies, nonprofits, and employer programs to perhaps make a difficult situation a bit more manageable.

--

About the Author

Jack Brkich III, is the president and founder of JMB Financial Managers. A CERTIFIED FINANCIAL PLANNERTM, Jack is a trusted advisor and resource for business owners, individuals, and families. His advice about wealth creation and preservation techniques have appeared in publications including The Los Angeles Times, NASDAQ, Investopedia, and The Wall Street Journal. To learn more visit https://www.jmbfinmgrs.com/.

Jack Brkich III, is the president and founder of JMB Financial Managers. A CERTIFIED FINANCIAL PLANNERTM, Jack is a trusted advisor and resource for business owners, individuals, and families. His advice about wealth creation and preservation techniques have appeared in publications including The Los Angeles Times, NASDAQ, Investopedia, and The Wall Street Journal. To learn more visit https://www.jmbfinmgrs.com/.

Connect with Jack on LinkedIn or follow him on Twitter.

Sources:

- AARP, July 24, 2025

https://www.aarp.org/caregiving/basics/caregiving-in-us-survey-2025.html?utm_source=chatgpt.com - Caregiving in the U.S. Research Report, July 2025

https://www.aarp.org/content/dam/aarp/ppi/topics/ltss/family-caregiving/caregiving-in-us-2025.doi.10.26419-2fppi.00373.001.pdf - Caring Together, August 2025

https://caringtogethersbc.org/blog/addressing-caregiver-stress - Market Watch, July 10, 2025

https://www.marketwatch.com/story/more-older-people-than-children-now-need-caregiving-governments-and-employers-need-to-step-up-f4ce0f1b?utm_source=chatgpt.com - The Wall Street Journal, September 4, 2024

https://www.wsj.com/personal-finance/caregiving-aging-at-home-retirement-103520c7?utm_source=chatgpt.com - LongTermCare.gov, August 2025

https://acl.gov/ltc/costs-and-who-pays/who-pays-long-term-care - Senior Living, February 14, 2025

https://www.seniorliving.org/research/family-caregiver-report-statistics/ - Zen Caregiving Project, August 19, 2025

https://zencaregiving.org/navigating-family-conflict-over-care-decisions/

JMB Financial Managers Mid-Year Review for 2025

Click the button below to download a pdf of insights and predictions for the rest of the year.