Record Retention Guidelines for Business Owners

Submitted by JMB Financial Managers on March 17th, 2020

Tax season is in full swing again and I often get asked how long business owners should retain their tax and business records. Unfortunately, there is no hard and fast answer to this question.

How Long Should You Keep Your Records?

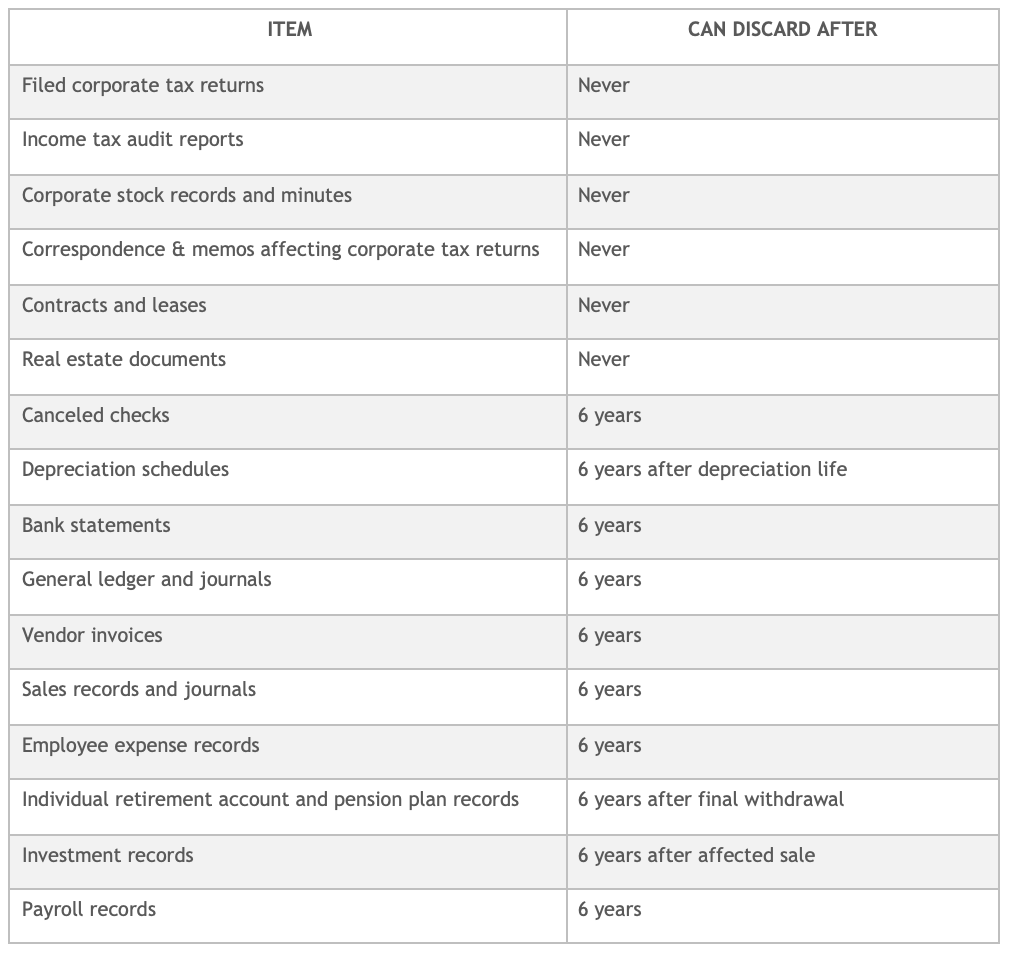

Some records are worth holding on to forever, since it can be hard to determine whether an issue from those documents may be relevant in future tax years. Here are some general guidelines for consideration.

Records You Should Never Discard:

- Corporate filed tax returns

- Income tax audit reports

- Corporate stock records and minutes

- Contracts and leases

- Real estate documents

For the rest of your records, a useful guide could be the six-year federal income tax statute of limitations period that applies for tax returns.

A recommended retention policy can be found below.

Recommended Retention Period for Tax and Business Records

This recommendation policy assumes that all returns have been filed in a timely manner, because the statute of limitations for income tax returns remains open for any unfiled returns. Note that legal and business considerations - other than federal income taxes - may result in retention periods longer than those recommended above. Please consult your legal team for further details.

As a practical matter, with the use of digital recordkeeping and storage, there is little extra cost to retain records for an extended period of time, other than perhaps potential readability issues in the future from using old storage media and file types.

Have Any Questions Regarding Your Records?

Understanding when you can discard old records and what you should hold onto can be difficult. If you need help clarifying what actions you should take with certain documents, please feel free to reach out to me at jack.brkich@ceteraadvisors or give the office a call at (949) 251-3544 to discuss your situation further.

--

About the Author

Jack Brkich III, is the president and founder of JMB Financial Managers. A Certified Financial Planner, Jack is a trusted advisor and resource for business owners, individuals, and families. His advice about wealth creation and preservation techniques have appeared in publications including The Los Angeles Times, NASDAQ, Investopedia, and The Wall Street Journal. To learn more visit https://www.jmbfinmgrs.com/.

Connect with Jack on LinkedIn or follow him on Twitter.

JMB Financial Managers Mid-Year Review for 2025

Click the button below to download a pdf of insights and predictions for the rest of the year.