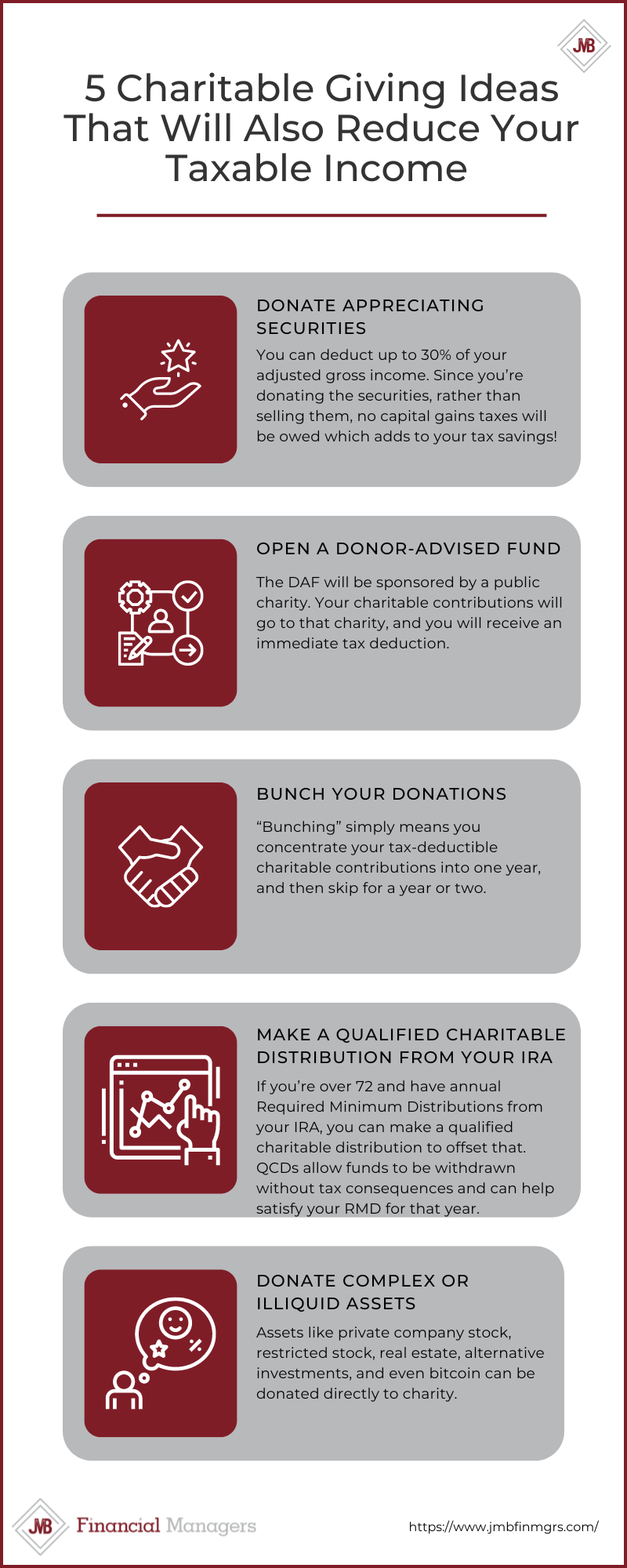

INFOGRAPHIC: 5 Charitable Giving Ideas That Will Also Reduce Your Taxable Income

Submitted by JMB Financial Managers on December 22nd, 2022

‘Tis the season of giving and, as the end of the year approaches, it is also the time to make year-end tax saving moves. Regardless of the tax benefits, giving back to your community, especially after the difficult year we’ve had, can truly change people’s lives. Luckily, supporting causes and communities in need leaves a lasting impact but also helps to lower your taxable income, allowing you to both support a cause you believe in and reduce the amount you owe in taxes.

If you itemize your deductions when filing taxes, last-minute charitable donations could help decrease your tax bill as contributions are deductible for the year in which it was paid. Here are 5 tips for how to reduce your taxable income while supporting causes that are meaningful to you.

Deductions For Business Owners

While itemizing your 2022 tax deductions, don’t forget that any “ordinary and necessary” business expenses are also tax-deductible. This can include the home-office deduction, reimbursement or write-offs for mileage, and any equipment or necessary items purchased for your job or office, so keep those receipts and track your expenses to save even more on taxes! For more information check out our blog, “5 Tips for Charitable Giving to Reduce Your Taxable Income”.

Need Help Planning Your Charitable Contributions?

If you have any questions about the tips mentioned here or need help planning how to make charitable contributions, don’t hesitate to contact us before the end of the year. Schedule a complimentary consultation today.

--

About the Author

Jack Brkich III, is the president and founder of JMB Financial Managers. A CERTIFIED FINANCIAL PLANNERTM, Jack is a trusted advisor and resource for business owners, individuals, and families. His advice about wealth creation and preservation techniques have appeared in publications including The Los Angeles Times, NASDAQ, Investopedia, and The Wall Street Journal. To learn more visit https://www.jmbfinmgrs.com/.

Jack Brkich III, is the president and founder of JMB Financial Managers. A CERTIFIED FINANCIAL PLANNERTM, Jack is a trusted advisor and resource for business owners, individuals, and families. His advice about wealth creation and preservation techniques have appeared in publications including The Los Angeles Times, NASDAQ, Investopedia, and The Wall Street Journal. To learn more visit https://www.jmbfinmgrs.com/.

Connect with Jack on LinkedIn or follow him on Twitter.

JMB Financial Managers Mid-Year Review for 2025

Click the button below to download a pdf of insights and predictions for the rest of the year.